The North American market for used trucks recovered last month from a dip in January, according to Price Digests, a trucking information services company.

Price Digests’ Price Stability Index, a measure of used truck values and the strength of the resale market in the U.S. and Canada, rose to 99 in February from 95.8 in January. A measure of 99 to 100 represents a stable market.

Price Digests, which collects data from used truck dealers and vehicle auctions, said the inventory of used trucks increased slightly in February from January. Inventory held steady at used truck dealers, but increased significantly at vehicle auctions, jumping from just 20 trucks in January to more than 400 in February.

Analysts at Price Digests expect a similarly high inventory of used trucks at auctions this month, but retail activity at used trucks dealers is expected to remain at about the same level before increasing later this year.

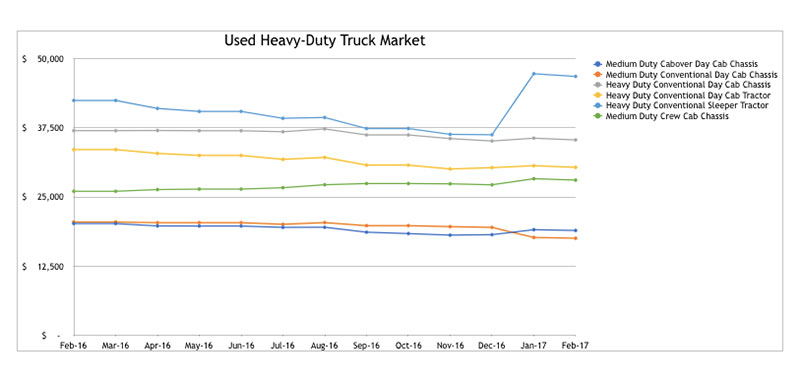

Used truck values averaged $38,520 in February, a 6.5 percent decline from the same period a year earlier. Price Digests attributes much of the decline to an abundance of older trucks reaching the used market.

The strongest pricing in February in the retail channel was for heavy-duty conventional sleeper tractors. Used truck values rose 10.2 percent to an average $46,824 from the same month a year earlier. Pricing for used sleeper tractors also was strong in January.

Auction prices tend to be a little lower and vary widely by vehicle and model year.

(Source: Price Digests)

According to a separate truck pricing analysis, auction companies recorded an average price of $34,000 for model year 2013 sleeper trucks in February, an increase of $7,500 over January, said Bobby Williams, used truck manager for East Texas Mack in Longview, Texas.

Trucks typically depreciate after five years when their warranties come off and new model year trucks come to market in January. That caused 2012 model year trucks to take a bigger drop in value from January to February, Williams said.

The value of trucks from the 2011 model year decreased 5 percent from January to February, he said.

Throughout 2016 prices for sleeper cabs dropped continuously because of higher availability, said Jessica Carr, senior analyst for Price Digests. These trucks enter the market at a faster pace because of their shorter lifespan, which creates an influx of volume.

Resale prices for medium-duty day cab chassis trucks medium-duty day cabs had the biggest decline, falling 14.3 percent from the same month a year earlier to $17,559.

The number of Volvo trucks on the resale market had the biggest gain in February, rising 148 percent to 6,533.

Volvo’s used truck inventory in January was unusually low and the large increase in February brought it back to its expected level, Carr said.

Navistar’s International brand had the most used trucks on the market with 10,718, narrowly beating Freightliner’s 10,032. Peterbilt had the biggest used inventory decline. The number of used Peterbilt trucks on the market fell 17.7 percent to 4,757.

Used truck prices were stable in most of the U.S., according to Price Digests. However, used truck values in Canada saw declines from January.

Source: Trucks