A healthy U.S. economy has shipping rates poised to head higher, but an upcoming federal mandate to equip long-haul trucks with electronic logging devices could disrupt the industry and launch trucking prices into an even more rapid ascent.

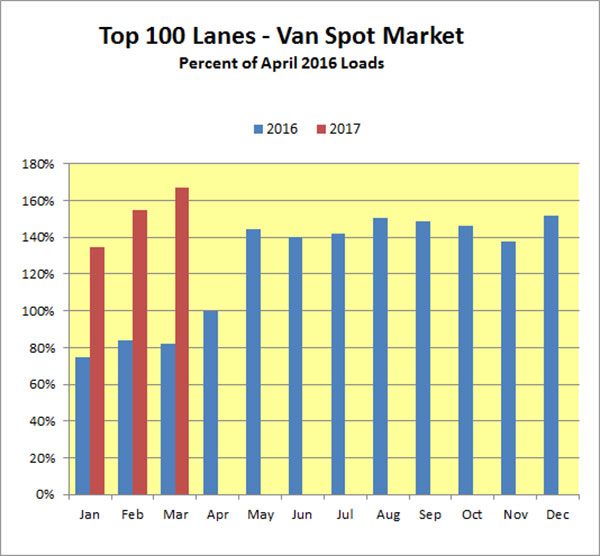

Carriers are seeing the leading edge of a freight wave, according to analysts at DAT, an online freight exchange. For the first three months of 2017, load volumes are running 100 percent above the level of the same period a year earlier. And this is before April, when the peak season for freight usually kicks off.

Already, some rates have started to creep up. Spot van linehaul rates – without fuel surcharges added in – are 2.2 percent higher year-over-year, according to DAT. Flatbed truck linehaul rates are 2.9 percent higher. Spot rates – which are individually negotiated between what are typically small carriers and independent truckers and brokers – tend to be volatile. Contract rates – which are long-term agreements between carriers and shippers – move more slowly.

100 top truck lanes chart

The spot rates probably would be much higher now, except that in the first two months of this year, the industry saw an influx of contract carriers offering up their trucks on the spot market, which increased capacity and tamped down rates. Once those trucks go back to hauling contract freight, spot rates could rise significantly, according to DAT.

This all signals a modest near term recovery for the trucking industry, which can expect see higher rates in both the spot and contract markets, said Mark Montague, industry pricing analyst for DAT.

But the trucking industry and shipping rates are both driving into uncharted territory this December, when a federal mandate will require roughly 500,000 U.S. trucking firms to equip their rigs with electronic logging devices, or ELDs.

The ELDs will replace the paper logs that drivers use to document adherence to federal regulations on how many hours they are on the road.

Large contract carriers have adopted the ELD, but midsized carriers are a “mixed bag,” Montague said.

“We are still waiting to see what happens with the small carriers, but in order for some to stay afloat they massage the log books – 15 minutes can be the difference between completing a load or rolling it into the next day,” he said.

There are about 190,000 carriers with fewer than 20 trucks, Montague said.

Many drivers and carriers – particularly owner-operators and small carriers – will leave the industry when the mandate becomes official law, said Gail Levario, EROADS’ vice president of strategy and market development.

“If that prediction is true, then it is not hard to imagine that it could result in a serious capacity issue – potentially losing between 3 and 5 percent once ELDs are mandatory,” Levario said.

That will leave shippers dealing with fewer trucks on the road to haul their good and rising spot rates, Levario said. Contract rates will react more slowly as the terms are renegotiated, she said.

A reader survey by Overdrive, a trucking magazine, indicated that 71 percent of independents and small fleet owner-operators said they would quit before complying with the ELD requirement.

“The latter claim is difficult to imagine and while it no doubt reflects the emotion of the respondents it more than likely does not reflect the economic reality of these drivers needing to continue to make a living,” Levario said.

This is an issue the logistics industry is watching carefully.

“How strictly ELDs will be enforced, however, is a critical unanswered question,” Michael Baudendistel, a Stifel Financial Corp. analyst, wrote in a report to investors Thursday. “Several fleets mentioned productivity declines of 8 percent to 10 percent after initial implementation (with some as high as 15 percent and up), though a portion of those initial losses are gained back with better training.”

Small trucking firms and independent drivers also will have to shell out the initial acquisition cost and the ongoing monthly subscription cost of ELD operation.

Electronic logging devices can range from $165 to $832, with one of the more popular devices priced around $495 per truck, according to Eldfacts.com.

A dramatic drop in trucking capacity would be a shock to the U.S. economy.

Trucking hauls about 70 percent of tonnage carried by all modes of domestic freight transportation, according to the American Trucking Associations. The industry accounts for about $726.4 billion in freight business, or 81.2 percent of total revenue earned by all transport modes.

Any increase in shipping rates as an outfall of the ELD mandate would come against of backdrop of already rising rates. That’s because shipping prices are closely tied to the economic environment, which is improving, according to economists.

“GDP is expected to accelerate in the second quarter to 2.2 percent from 1.6 percent in the first,” said Scott Anderson, chief economist for Bank of the West.

“Trucking and transportation will benefit as manufacturing activity picks up in the months ahead,” Anderson said.

The ISM Manufacturing index – which monitors employment, production, inventories, new orders and supplier deliveries – has already moved into solid expansion territory and industrial production is expected to follow, he said.

Despite a small dip in February, freight tonnage is expected to pick up in the months ahead due to economic growth, according the ATA.

Among myriad factors that drive tonnage, an increase in the oil rig count is an important indicator.

The number of oil rigs in the U.S. is on the upswing, rising to 789 last week from 768 in the prior week and 476 compared with the same week a year earlier, according to the Baker Hughes rig count, an important barometer for the oil industry.

The price of West Texas Intermediate crude averaged $53.47 per barrel in February, up from a 13-year low of $30.32 in February 2016, according to the U.S. Energy Information Administration.

Oil is also closely tied to the comeback of flatbed freight because they carry the equipment used to build rigs and keep them running, Montague said.

The expansion of the natural gas industry along the coasts of Texas and Louisiana is also providing a stimulus to freight volume.

And the rain in California is benefitting the refrigerated food sector following a deep lull caused by the drought, he said.

“Now with the rain, the question is, how fast can farmers plant?” Montague said.

Source: Trucks