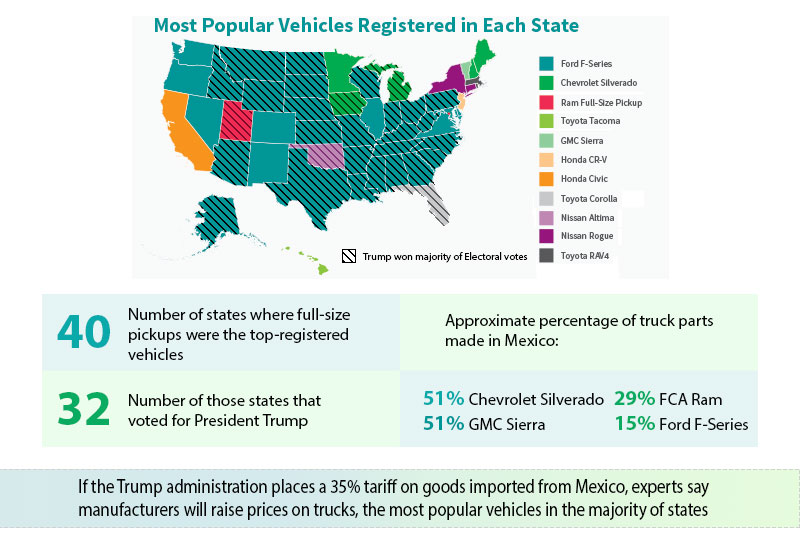

President Donald Trump’s campaign promise to withdraw from the North American Free Trade Agreement and place a 35 percent tariff on goods imported from Mexico could roil the market for pickup trucks – the most American of vehicles.

U.S. consumers purchased 2.7 million pickup trucks last year. Encouraged by low gas prices, buyers continue to gravitate to the large vehicles for their high profile, ample space and particularly American styling.

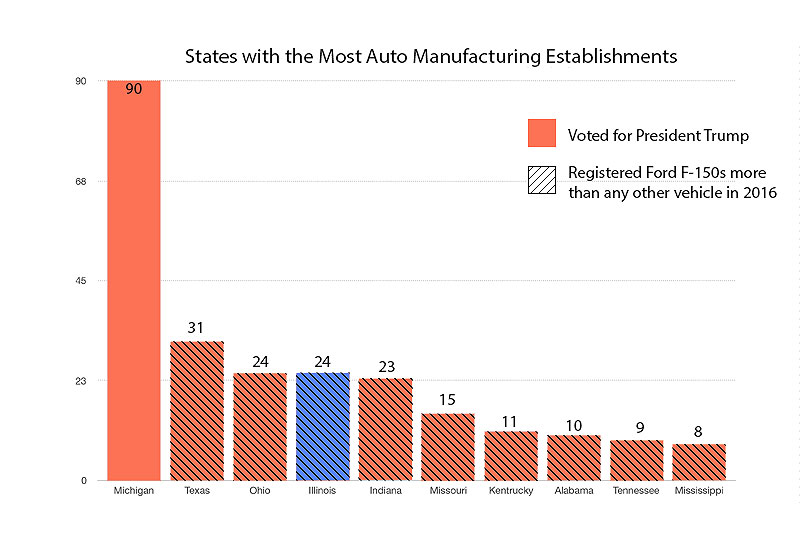

But even when trucks are built domestically, a significant portion of their parts come from across the Southern border. The reliance on Mexico for parts sourcing or full assembly of U.S. trucks could expose automakers to looming fees and tariffs, and force them to raise prices on their most popular vehicles, experts say.

“The North American industry is extremely integrated, I would say more so than probably any other regional industries,” said Kristin Dziczek, director of industry and labor economics at the Center for Automotive Research, or CAR. “Disentangling this will be very difficult.”

For instance, roughly 51 percent of parts in the Chevrolet Silverado and GMC Sierra are made in Mexico, as are 29 percent of parts in Ram full-size trucks and 15 percent of parts in the Ford F-Series, according to the National Highway Traffic Safety Administration. The Toyota Tundra and Nissan Titan also source parts from Mexico.

In addition, some versions of the Silverado and Sierra are assembled in Silao, Mexico, as is the case with Rams, some of which are built in Saltillo, Mexico. Both companies source engines from Mexico.

Levying a 35 percent tariff on Mexican goods could cost the American auto industry annual sales of 450,000 vehicles, according to a recent report by CAR. The same study estimated that withdrawing from NAFTA would also cause vehicle prices to increase.

Graphics reporting by Ryan ZumMallen and Alana Goldenberg/Trucks.com

In addition to the tariff or withdrawal from NAFTA, Dziczek said, a border adjustment tax such as the measure pitched by House Speaker Paul Ryan and the Republican leadership provides its own set of challenges. Part of the issue is that rough estimates do not provide an entirely accurate picture of how many parts come from Mexico, and how many times they may cross the border during the production process.

“It’s very difficult to say right now whether that’s going to be a positive for the auto industry,” she said. “But straight out of the gate we think it raises prices.”

The Supply Side

Parts suppliers with production plants in Mexico may be forced to raise prices or undergo costly moves back to the U.S. too, according to CAR. Its report estimated that few suppliers would cross borders, and automakers would simply source parts and production outside of NAFTA countries rather than bringing the work into the U.S.

“We rate the announcements of the new U.S. president critical,” said Peter Renz, spokesperson for manufacturing giant ElringKlinger AG.

The company produces parts for several automakers, including cylinder head gaskets for the Silverado and Sierra from its facility in Toluca, about 40 miles west of Mexico City.

“We think that protectionist measures such as punitive duties, import taxes or the termination of international trade agreements are not an effective tool in our globalized world,” Renz said. “The uncertainty paralyzes the entire automotive and supplier industry.”

Renz said that ElringKlinger is in a better position than many suppliers because the company has plants in the U.S. as well.

But the CAR report predicts that withdrawing from NAFTA or placing a tariff on Mexican goods would cause the U.S. auto market to shrink, potentially drying up job opportunities in domestic plants such as those owned by ElringKlinger.

(Sources: Center for Automotive Research, IHS Markit, Politico)

The Motor Equipment & Manufacturers Association, or MEMA, which represents automotive suppliers, recently voiced support for tax reform favored by the Trump administration, but warns that a tariff “could disrupt the integrated supply chain for many companies” by raising costs and prices, lowering sales and capital for new research, and decreasing manufacturing jobs.

Others aren’t so convinced.

“Even if the headline is dramatic, the fine print is going to be different,” said James Rubenstein, an automotive expert and professor of geography at the University of Miami, Ohio.

There are too many unknowns to determine what tariffs or NAFTA withdrawal will mean, said Rubenstein, and automakers could ask for special provisions considering the complexity of their operations.

“There’s going to be cleverness in the fine tuning,” he said.

The Bottom Line

Truck sales are vital to U.S. automakers because they deliver greater profit than other types of vehicles. General Motors generated 100 percent of its profits from trucks and large SUVs in 2016, Adam Jonas, an analyst at Morgan Stanley Research, wrote in a recent investor report.

The average price of a light-duty full-size pickup truck has already increased more than 20 percent between 2012 and 2016, to over $39,000, according to industry research firm J.D. Power. The price of heavy-duty full-size pickup trucks has risen 14.4 percent to more than $50,000 during that time.

The industry could see changes sooner rather than later. According to Inside U.S. Trade, a trade publication, U.S. Commerce Secretary Wilbur Ross told Democrats on the House Ways and Means Committee that he plans to launch a 90-day review process necessary to open NAFTA renegotiations sometime this month.

But during a meeting of the Detroit Economic Club this month, Mexico’s economy minister Ildefonso Guajardo Villarreal said that NAFTA countries should appreciate an agreement that is working. Canada, Mexico and the United States produced more than 17.8 million light vehicles in 2016, according to the CAR report. The report also predicted U.S. automotive capacity would increase 11 percent and Mexican capacity 45 percent by 2023.

“It’s not very wise to sit down to negotiate something with a very skewed or sharp perspective that there has been only one winner in this deal,” Villarreal said. “We all have been winning in this deal.”

Source: Trucks